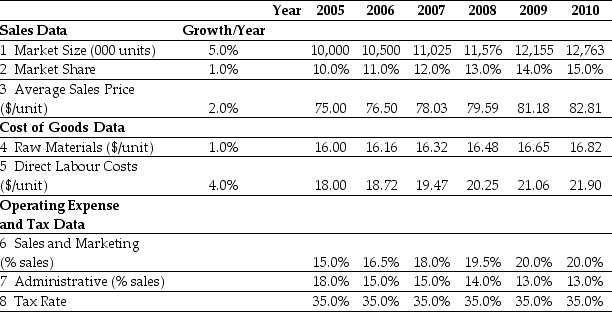

Use the table for the question(s) below.

Ideko Sales and Operating Cost Assumptions

-Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity will Ideko require in 2007?

Definitions:

Microcentrifuge

A laboratory device used for the rapid spinning of samples to separate components based on density.

Body Fluids

Liquids within humans and other living organisms that transport nutrients and waste products, including blood, lymph, and interstitial fluid.

Safety Glasses

Protective eyewear designed to safeguard the eyes from flying debris, chemicals, or harmful radiation.

Soap And Water

A basic cleaning method involving the use of soap and water to remove dirt, debris, and microbes from surfaces.

Q8: You have shorted a call option on

Q9: Which of the following short-term securities would

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" Harrison Products is

Q13: Assume that Omicron uses the entire $50

Q30: Consider two firms,Thither and Yon.Both companies will

Q49: Which of the following is a firm's

Q60: Which of the following statements is FALSE?<br>A)While

Q69: Suppose you purchase a call option for

Q72: A firm has $500 million of assets

Q91: A financial manager who wants her investment