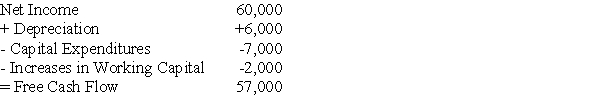

Vega Music's projected net income and free cash flows are given above in thousands of dollars.Vega expects that their net income and increases in net working capital to increase by 5% per year.If Vega were able to reduce its annual increase in working capital by 10% without affecting any other part of the business adversely,what would be the effect of this reduction on Vega's value,given a cost of capital of 13%?

Definitions:

Negative Cumulative Cash Surplus

A financial situation where the cumulative cash flows from a project or business are negative, indicating a deficit.

Borrowing Need

The necessity for an individual or organization to raise funds through loans or debt issuance to finance its operations or investments.

Costs Of Placing An Order

Expenses associated with ordering inventory, including administrative costs, shipping, handling, and procurement costs, critical in managing inventory levels.

Shortage Cost

Costs incurred from not having enough inventory or resources to meet demand, including lost sales and dissatisfied customers.

Q14: Which of the following statements regarding leases

Q21: _ asserts that because a forward contract

Q22: Which of the following statements is FALSE?<br>A)The

Q31: Suppose that instead of leasing the bulldozer,the

Q41: When investors use leverage in their own

Q41: In a perfect capital market,when a dividend

Q48: This graph depicts the payoffs of a<br>A)a

Q48: When a firm's investment decisions have different

Q64: Palo Alto Enterprises has $300,000 in cash.They

Q89: What are the five C's of Credit?