Use the table for the question(s) below.

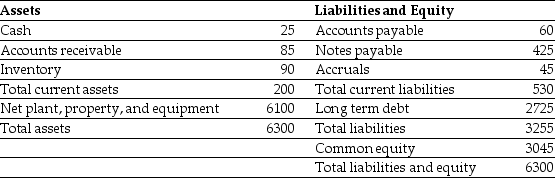

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2019.A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31,2019

(millions of dollars)

-Luther's cash conversion cycle is closest to:

Definitions:

Nervous System

The network of nerve cells and fibers that transmits nerve impulses between parts of the body, overseeing both voluntary actions and involuntary responses.

Electrical

Pertaining to the science of electricity, involving the study and application of electrical energy, phenomena, and properties.

Chemical

A chemical is a substance composed of matter that has a constant composition and characteristic properties.

Multi-Unit Recording Procedures

Techniques used in neuroscience to record the electrical activity from multiple neurons simultaneously, often to study the brain's functional properties.

Q5: Forecasting a balance sheet with percent of

Q16: A company issues a callable (at par)20-year,5%

Q37: Based upon the average EV/Sales ratio of

Q49: Which of the following statements is FALSE?<br>A)Because

Q88: What are internationally segmented capital markets?

Q89: According to the _ theory of payout

Q92: What are some of the disadvantages of

Q94: The idea that dividend changes reflect managers'

Q102: What role do industries play in the

Q103: A firm has $200 million of assets