Use the table for the question(s) below.

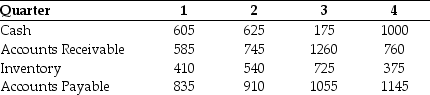

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions) :

-The temporary working capital needs for Hasbeen Toys in quarter 3 is closest to:

Definitions:

Penetration Pricing

A pricing strategy where the price of a product is initially set low to rapidly reach a wide fraction of the market and stimulate product adoption.

Above-market Pricing

Setting the price of a product or service higher than the prevailing market price, often as a strategy to signal superior quality or exclusivity.

Swedish Company

A business entity that is registered and operates within Sweden, adhering to the country's regulatory and business environment.

Prestigious Appliances

High-end home appliances that are revered for their quality, performance, and brand reputation.

Q11: The Law of One Price asserts that

Q14: Commercial Supply Corp.bills its accounts on terms

Q15: Which of the following do firms consider

Q21: What is corporate governance?

Q27: With the proper changes it is believed

Q34: _ is the amount of additional external

Q39: The present value (PV)of the £5 million

Q48: A firm can repurchase shares through a(n)_

Q63: Which of the following statements is FALSE?<br>A)With

Q105: A firm has a committed line of