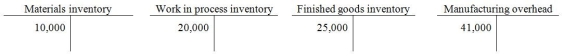

On June 1, 2012, Dalton Production Company had beginning balances as shown in the T-accounts below.  During June, the following transactions took place:

During June, the following transactions took place:

June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

June 13: Pay $7,500 of direct factory labor cost, and $14,100 of indirect factory labor cost.

-

Following these transactions, what was the balance in the Manufacturing overhead account?

Definitions:

Annual Payments

Yearly amounts paid or received over the term of a financial instrument or agreement.

Lessor

The party in a lease agreement who owns the leased asset and grants the lessee the right to use the asset for a specified term in exchange for payment.

Amortization Policies

Guidelines or practices a company follows to systematically reduce the book value of its intangible assets over their useful life.

Capital Lease

A long-term lease agreement considered to be a purchase of the asset for accounting purposes, where the lessee assumes both the risks and benefits of asset ownership.

Q3: Companies that use activity-based costing do NOT

Q6: The first step in the activity-based costing

Q31: In 2012, the Doric Agricultural Products

Q34: <br>Please perform a process costing analysis and

Q43: Victory Company makes a special kind of

Q78: If fixed costs go up and all

Q103: When job order costing is used in

Q111: What kind of information does the dividend

Q140: <br>How much is the days in inventory

Q140: <br>With the current cost structure, Origami cannot