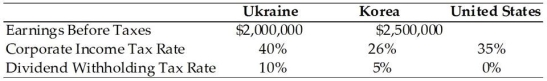

TABLE 15.1

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. How much in additional U.S. taxes would be due if BayArea averaged the tax credits and liabilities of the two foreign units, assuming a 50% payout rate from each?

Definitions:

Self-sufficient Entity

An organization or individual that can fulfill all of its needs without external assistance.

Surrounding Environment

The external conditions, influences, and factors that impact an individual's or organization's ability to operate and make decisions.

Open System

An entity or organization that interacts with its environment, exchanging information and resources.

Global Customer Service

The provision of customer support and services to clients worldwide, often requiring multilingual capabilities and an understanding of diverse cultural norms.

Q12: Bretton Woods required less in the way

Q17: An MNE has a contract for a

Q24: A balance sheet hedge requires that the

Q28: The growth in the influence and self-enrichment

Q42: In international capital budgeting,the appropriate discount rate

Q50: Most swap dealers arrange swaps so that

Q61: The study of how shareholders can motivate

Q63: The authors describe a process for development

Q73: Because of the risks involved in international

Q79: Use of the International CAPM (ICAPM)assures that