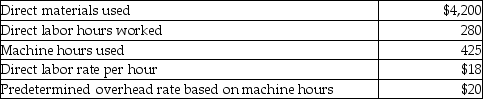

Cooper's Company manufactures custom engines for use in the lawn and garden equipment industry.The company allocates manufacturing overhead based on machine hours.Selected data for costs incurred for Job 798 are as follows:

What is the total manufacturing cost of Job 798?

Definitions:

Q1: Hummingbird Manufacturing manufactures small parts and uses

Q18: A(n)_ is an estimated manufacturing overhead rate

Q35: Indirect materials,indirect labor,and indirect manufacturing costs are

Q53: Management can use job cost information to

Q72: Sunk costs are irrelevant to the decision

Q80: The use of which of the following

Q153: The allocation base selected for each department

Q220: The _ element in the value chain

Q250: Carrol Company,which uses an activity-based costing system,produces

Q331: A job cost record is a document