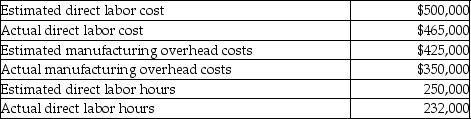

Federer Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead.The following information is available for the most recent year:

If Federer Company uses direct labor hours as the allocation base,what would the allocated manufacturing overhead be for the year?

Definitions:

Acquisition Indebtedness

Debt incurred in acquiring, constructing, or substantially improving a qualified residence of the taxpayer, and secured by the residence.

Qualified Residence Interest

Interest paid on a mortgage for a primary or secondary residence, which can be deductible for taxpayers who itemize deductions.

Deductibility

The extent to which an expense can be subtracted from gross income to reduce taxable income and lower the tax liability.

Written Acknowledgment

A written statement confirming the receipt of something, often used in tax documentation for charitable donations.

Q7: Which of the following cost of quality

Q76: Spruce Company uses a job costing system.Spruce

Q90: Which of the following product costing systems

Q92: What ethical standard is being violated when

Q140: All of the components of manufacturing -

Q169: Which of the following is an example

Q195: Kramer Company manufactures coffee tables and uses

Q219: A plantwide overhead rate is calculated by

Q243: Company X sells widgets.The following information summarizes

Q257: In a mass-production environment,direct labor is usually