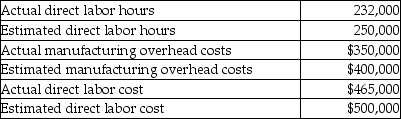

Nadal Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead.The following information is available for the most recent year:

If Nadal Company uses direct labor hours as the allocation base,what would the allocated manufacturing overhead be for the year?

Definitions:

Income Tax Rate

The percentage at which an individual or corporation is taxed, often varying based on income or profit levels.

Capital Budgeting

Capital budgeting involves the process of analyzing and evaluating investment decisions in long-term assets to maximize an entity's value.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, simplifying the accounting process.

Cash Flow

The total amount of money being transferred into and out of a business, particularly its liquidity level over a defined period.

Q60: A service firm's costs are comprised of

Q88: How would Chevrolet classify its partially completed

Q90: When an item is sold,Finished Goods Inventory

Q93: Management can use job cost information for

Q95: For a manufacturer,beginning work in process would

Q160: A company produces toy airplanes at a

Q175: At a service company,the indirect costs of

Q192: Joe's Bottling Company provided the following expense

Q322: Which of the following entries would be

Q334: The predetermined indirect cost allocation rate is