Calculate the unknowns for the following independent situations.

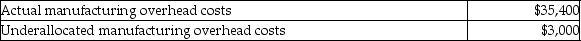

1.Selected data for Lion Corporation:

Allocated manufacturing overhead is based on 50% of direct labor cost.

a.Calculate the allocated manufacturing overhead cost.

b.Calculate the direct labor cost.

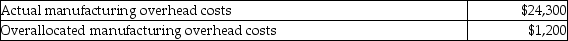

2.Selected data for Tiger Corporation:

Manufacturing overhead is allocated at $15 per machine hour.

a.Calculate the allocated manufacturing overhead cost.

b.Calculate the number of machine hours incurred.

Definitions:

Fair Value Option

An accounting choice giving companies the opportunity to measure financial assets and liabilities at their fair values with changes reflected in the income statement.

Net Income

Net income represents the total earnings of a company once all costs, expenses, and taxes are deducted from its total revenue.

Dividends

Dividends are a portion of a company's earnings distributed to shareholders, usually in the form of cash payments or additional stock.

Equity Method

An accounting technique used to record investments in other companies, where the investment is initially recorded at cost and subsequently adjusted to reflect the investor's share of the net assets of the investee.

Q9: How do you calculate the predetermined manufacturing

Q29: Watson's Computer Company uses ABC to account

Q29: Which of the following entries would be

Q64: One key element of lean production is

Q88: Manufacturing overhead is overallocated if the amount<br>A)allocated

Q159: The manager at East Coast Manufacturing organizes

Q199: The schedule of cost of goods manufactured

Q202: The new manager at Sailboat Manufacturing oversees

Q208: On a Cost of Quality report,which of

Q217: The cost of evaluating potential raw material