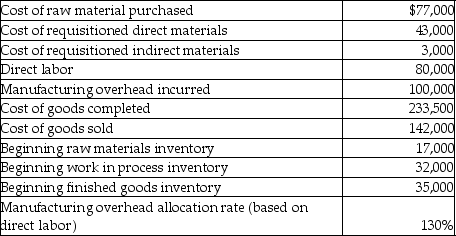

Here is selected data for Lori Corporation:

The journal entry to close manufacturing overhead would include a

Definitions:

Traditional IRA

A type of retirement account that offers tax-deferred growth, with taxes being paid only upon withdrawal in retirement.

Distributions

Money paid out to shareholders from a corporation's earnings or a fund's assets.

IRA Balance

Refers to the total amount of money that is currently saved within an Individual Retirement Account, a tax-advantaged retirement savings account.

401(k) Plan

A retirement savings plan sponsored by an employer that allows workers to save and invest a portion of their paycheck before taxes are taken out.

Q35: Indirect materials,indirect labor,and indirect manufacturing costs are

Q58: Departmental overhead rates typically do a better

Q114: Serena Corporation uses estimated manufacturing overhead costs

Q121: Indirect manufacturing costs should be included in

Q143: Back Porch Company manufactures lawn chairs using

Q167: The costs of adopting ABC may be

Q198: Here are selected data for Tyler Corporation:<br><img

Q204: Which of the following does ABC take

Q225: Using factory utilities would most likely be

Q288: Job 140 requires $12,000 of direct materials,$6,700