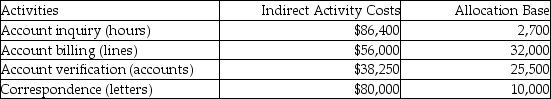

Potter & Weasley Company had the following activities,estimated indirect activity costs,and allocation bases:

Potter & Weasley uses activity based costing.

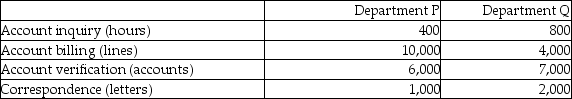

The above activities are used by Departments P and Q as follows:

How much of the correspondence cost will be assigned to Department P?

Definitions:

Capital Budgeting

The process of planning and evaluating investments in long-term assets to determine which projects will generate the most profitable returns.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, making the expense predictable and consistent.

Income Taxes

Taxes levied by governments on individuals' or businesses' net income, where the amount owed varies based on the level of the income earned.

Operating Cash Inflow

Cash generated from a company's primary business operations, excluding non-operational sources like investments or financing.

Q2: The following information is provided by Adametz

Q27: Waste can be reduced by implementing shorter

Q47: The total cost of a job shown

Q57: If manufacturing overhead has been overallocated during

Q103: Which of the following describes the way

Q106: The law firm of Lyons & Lyons

Q177: Conversion costs are generally added evenly throughout

Q201: On the line in front of each

Q244: Costs incurred to detect poor-quality goods and

Q249: Briefly explain the difference between job order