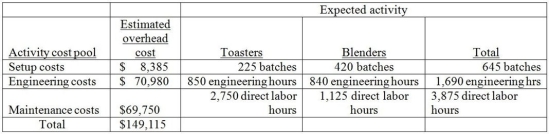

Vandalay Industries manufactures two products: toasters and blenders.The annual production and sales of toasters is 2,200 units,while 1,500 units of blenders are produced and sold.The company has traditionally used direct labor hours to allocate its overhead to products.Toasters require 1.25 direct labor hours per unit,while blenders require .75 direct labor hours per unit.The total estimated overhead for the period is $149,115.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The predetermined overhead allocation rate using the traditional costing system would be closest to

Definitions:

SIV Diversification

SIV Diversification refers to the process through which the Simian Immunodeficiency Virus (SIV) evolves and generates genetic variability among its populations.

Gene Coalesce

A concept in molecular genetics where different alleles at a gene locus in different lineages trace back to a single ancestral allele.

Allele Fixed

The situation in a population where all members carry the same allele of a particular gene, leading to the lack of genetic variation for that gene locus.

Population Size

The total number of individuals within a defined area at a given time.

Q15: The fixed cost per unit of activity

Q19: On a Cost of Quality report,which of

Q35: In process costing,units that are partially completed

Q67: In a particular department,8,200 units were started

Q121: The Akron Slugger Company produces various types

Q122: Outliers are abnormal data points.

Q159: The manager at East Coast Manufacturing organizes

Q211: If a company has 6,000 units that

Q224: Using account analysis,what type of cost is

Q291: State whether each company below would be