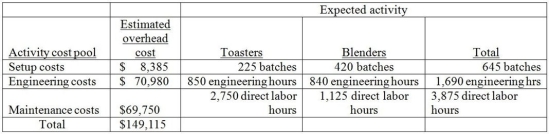

Vandalay Industries manufactures two products: toasters and blenders.The annual production and sales of toasters is 2,200 units,while 1,500 units of blenders are produced and sold.The company has traditionally used direct labor hours to allocate its overhead to products.Toasters require 1.25 direct labor hours per unit,while blenders require 1 direct labor hours per unit.The total estimated overhead for the period is $149,115.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The cost pool activity rate for Engineering Costs would be closest to

Definitions:

Levator Scapulae

A muscle located in the side and back of the neck that elevates the shoulder blade.

Serratus Anterior

A muscle that originates on the surface of the upper eight or nine ribs and inserts along the entire anterior length of the medial border of the scapula.

Pectoralis Minor

A thin, triangular muscle located beneath the pectoralis major in the chest, which plays a role in movements of the shoulder.

Rhomboideus Major

A muscle in the upper back that connects the scapula with the vertebral column, aiding in the shoulder's retraction and rotation.

Q16: Unit variable costs do not change as

Q18: The equation for a straight line is

Q69: The plantwide overhead cost allocation rate is

Q89: The last step of the 5-step process

Q102: At a manufacturing company,inventory flows from work

Q128: London Plastics sells a product for $15.00

Q160: A manufacturer of plywood would use what

Q160: The Akron Slugger Company produces various types

Q166: If all direct materials are added at

Q188: Here are selected data for Bailey Company:<br><img