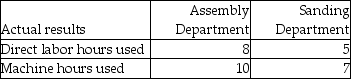

James Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Assembly and Sanding.The Assembly Department uses a departmental overhead rate of $35 per machine hour,while the Sanding Department uses a departmental overhead rate of $20 per direct labor hour.Job 603 used the following direct labor hours and machine hours in the two departments:

The cost for direct labor is $30 per direct labor hour and the cost of the direct materials used by Job 603 is $1,400.

How much manufacturing overhead would be allocated to Job 603 using the departmental overhead rates?

Definitions:

Uniform Partnership Act

A law enacted to standardize the rules and regulations governing business partnerships in the United States.

Earliest Version

The initial form or release of a document, product, or software before any updates or revisions.

Pass-Through Entity

A business structure that allows profits to be 'passed through' directly to the owners or shareholders, avoiding corporate income tax.

Federal Income Taxes

Taxes levied by the U.S. federal government on the annual incomes of individuals, corporations, trusts, and other legal entities.

Q43: Which of the following is one of

Q49: Ready Company adds direct materials at the

Q147: The following account balances at the beginning

Q152: Cooper's Bags Company manufactures cloth grocery bags

Q154: The goal of value-engineering is to<br>A)improve value-added

Q181: Job 450 requires $9,800 of direct materials,$6,400

Q211: If a company has 6,000 units that

Q270: The following is selected financial data from

Q323: Here is some basic data for Shannon

Q327: A production schedule indicates the quantity and