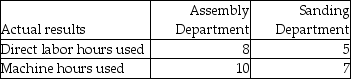

James Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Assembly and Sanding.The Assembly Department uses a departmental overhead rate of $35 per machine hour,while the Sanding Department uses a departmental overhead rate of $20 per direct labor hour.Job 603 used the following direct labor hours and machine hours in the two departments:

The cost for direct labor is $30 per direct labor hour and the cost of the direct materials used by Job 542 is $1,400.

What was the total cost of Job 542 if James Industries used the departmental overhead rates to allocate manufacturing overhead?

Definitions:

Companys

Pertaining to a business entity or firm, typically involving its ownership, operations, or assets.

Spelled Correctly

The accuracy of arranging letters in proper order to form words, adhering to the linguistic norms and standards of the language.

Courses Online

Academic or training programs offered over the internet, allowing participants to learn remotely without attending a traditional classroom.

Spelled Correctly

This phrase describes words that are written with the correct sequence of letters according to standard or accepted usage.

Q1: Selected information regarding a company's most recent

Q33: If a company uses departmental overhead allocation

Q72: Sunk costs are irrelevant to the decision

Q76: Using departmental overhead rates is generally less

Q101: Traditional cost systems with a single-allocation base

Q134: If all direct materials are added at

Q150: Manufacturing overhead is underallocated if the amount<br>A)estimated

Q189: Nadal Company is debating the use of

Q238: Potter & Weasley Company had the following

Q278: Manufacturing overhead is overallocated if the amount<br>A)estimated