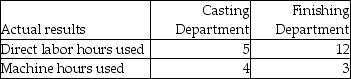

Ryan Fabrication allocates manufacturing overhead to each job using departmental overhead rates.Ryan's operations are divided into a metal casting department and a metal finishing department.The casting department uses a departmental overhead rate of $52 per machine hour,while the finishing department uses a departmental overhead rate of $28 per direct labor hour.Job A216 used the following direct labor hours and machine hours in the two departments:

The cost for direct labor is $32 per direct labor hour and the cost of the direct materials used by Job A216 is $1,800.

What was the total cost of Job A216 if Ryan Fabrication used the departmental overhead rates to allocate manufacturing overhead?

Definitions:

Assistant's Salary

The compensation provided to an assistant, which could vary based on industry, role, experience, and location.

Economic Profit

The delta between aggregate sales and all-inclusive costs, factoring in both overt and covert costs.

Own Capital

The personal funds contributed by the owners or shareholders to a business for startup or expansion, representing equity in the firm.

Operating Profit

The profit earned from a firm's normal core business operations.

Q18: A(n)_ is an estimated manufacturing overhead rate

Q40: Back Porch Company manufactures lawn chairs using

Q83: Fun Stuff Manufacturing produces frisbees using a

Q100: Here are selected data for Sally Day

Q108: Which of the following would be an

Q160: Fun Stuff Manufacturing produces frisbees using a

Q187: To record the costs of indirect labor,which

Q205: In a process costing environment,direct labor and

Q210: To determine the amount of overhead allocated,the

Q221: If manufacturing overhead has been overallocated during