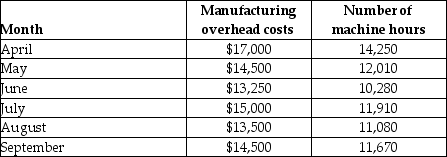

Paula Corporation is trying to predict its manufacturing overhead costs for the upcoming year;they are debating the use of the high-low method versus the use of regression analysis.They have gathered information about their manufacturing overhead costs in each of the past six months.A table containing their cost data and the associated machine hours in each month (the cost driver)follows.

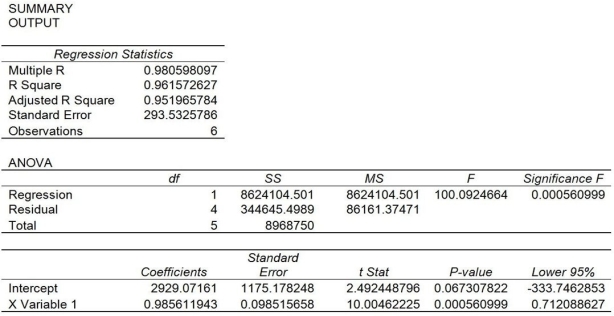

The company performed a regression analysis using the above data and had the following results.(Note: the results are excerpts so not all of the regression analysis results are presented. )

Required:

a.What is the cost equation if the high-low method is used to estimate costs?

b.Using the high-low method,predict total manufacturing overhead costs if Paula Corporation uses 12,000 hours.

c.What is the cost equation if regression analysis is used to estimate costs (use the results from the regression analysis provided)?

d.Using the results from the regression analysis provided,predict total manufacturing overhead costs if Paula Corporation uses 12,000 hours.

e.Which method (high-low or regression analysis)is a better predictor of total manufacturing overhead costs? Why?

Definitions:

Net Income

The net income of a business, which remains after deducting all costs, taxes, and expenses from the gross revenue.

Deferred Tax Asset Account

An account on the balance sheet representing taxes paid or carried forward but not yet realized, which can be used to offset future tax liabilities.

Earnings Quality

An assessment of the reliability and sustainability of a company's earnings, considering its ability to generate cash flow.

Effective Income Tax Rate

This rate is the average percentage that companies or individuals pay in taxes on their taxable income.

Q46: On a contribution margin income statement,sales revenue

Q54: Assume no beginning WIP Inventory.The ending WIP

Q61: Brambles Corporation has two sequential processing departments:

Q102: Which of the following is not an

Q117: Wallace Incorporated wanted to determine the relationship

Q130: Indirect labor would not be a component

Q145: Companies operating in highly competitive industries are

Q199: Which type of cost behavior is indicated

Q241: The cost of warranty work is an

Q265: Stanley's Bicycles store buys bicycles on average