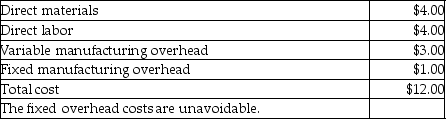

Cruise Company produces a part that is used in the manufacture of one of its products.The unit manufacturing costs of this part,assuming a production level of 6,000 units,are as follows:

Assuming Cruise Company can purchase 6,000 units of the part from Suri Company for $14 each,and the facilities currently used to make the part could be rented out to another manufacturer for $24,000 a year,what should Cruise Company do?

Definitions:

Transfer Payments

Payments made by governments to individuals without any expectation of a good or service being provided in return, such as social security benefits and unemployment benefits.

Excise Tax

A tax levied on specific goods, services, or transactions, often focused on items such as alcohol, tobacco, and gasoline.

Demand Curves

A graph showing the relationship between the price of a good and the quantity of that good that consumers are willing to buy at different prices.

Supply Curves

Graphical representations showing the relationship between the price of a good and the quantity of the good that suppliers are willing to sell.

Q15: Civic Corporation provided the following partially completed

Q17: Fancy Furniture has variable expenses of 40%

Q43: Blue Technologies manufactures and sells DVD players.Great

Q109: Contribution margin income statement data for the

Q156: The fixed expenses of Greg's Snowboards are

Q172: Neon Company manufactures widgets.The following data is

Q172: Expected purchases for June and July are

Q191: Moon Appliance manufactures a variety of appliances

Q199: The store manager at the Dick's Sporting

Q210: The Box Manufacturing Division of the Allied