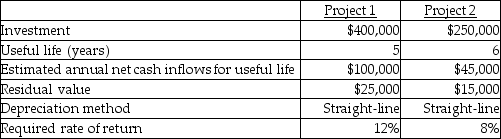

The Warren Company is considering investing in two alternative projects:

What is the accounting rate of return for Project 2?

Definitions:

Employer's Payroll Tax

Taxes that employers are required to pay on behalf of their employees, such as social security and Medicare taxes in the United States.

Unemployment Taxes

Taxes paid by employers to fund unemployment insurance programs, providing benefits to workers who have lost their jobs.

Payroll Tax Expense

Financial charges imposed on employers based on the wages and salaries paid to employees.

FICA Taxes Payable

Liabilities owed for Social Security and Medicare taxes, which are shared by employees and employers, and must be remitted to the government.

Q31: The purchase of inventory would be considered

Q60: Computing cash generated from operating activities is<br>A)the

Q78: A flexible budget is a budget prepared

Q88: Landrum Corporation is considering investing in specialized

Q105: In a company that uses the direct

Q112: Costanza Manufacturing gathered the following information for

Q132: (Present value tables are required. )Westin Manufacturing

Q165: The term _ is best described as

Q176: The McCumber Corporation data for the current

Q188: The _ department may be responsible to