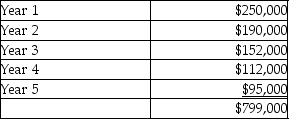

(Present value tables are needed. ) Somerville Corporation is considering investing in specialized equipment costing $618,000.The equipment has a useful life of 5 years and a residual value of $55,000.Depreciation is calculated using the straight-line method.The expected net cash inflows from the investment are:

Somerville Corporation's required rate of return is 14%.

The net present value of the investment is closest to

Definitions:

Decision-Critical Attributes

Those criteria the decision maker deems to be important and relevant for the purpose of evaluating options.

Pre-Editing Phase

The initial stage in editing or content creation where material is prepared, adjusted, or organized before the main or final editing process begins.

Decision-Critical Criteria

Key factors or standards considered essential in making a decision or judgment on an issue or option.

Dominance Structuring

The process of organizing or arranging elements, often in a hierarchical manner, to establish or maintain a dominant position.

Q1: A company uses the direct method to

Q21: Communication between environmental,production,and accounting staff is crucial

Q31: The Warren Company is considering investing in

Q52: The Hanna Company uses straight-line depreciation and

Q78: A flexible budget is a budget prepared

Q88: The managerial accountant at the Export Shoppe

Q112: The _ of the balanced scorecard focuses

Q137: The operating activities section of the statement

Q157: Sound Design sells its computer speakers for

Q159: The formula for calculating the accounting rate