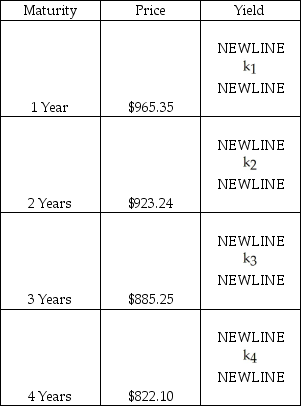

The prices of a number of $1,000 (face value) zero-coupon bonds are provided in the Table,below.Compute the yields on the zero coupon bonds.Plot the yield curve.What is the shape of the yield curve?

Definitions:

Net Present Value

A calculation that compares the present value of cash inflows to the present value of cash outflows over a period of time, used to assess the profitability of an investment.

Payback Period Method

A simple calculation that divides the initial investment by the annual cash inflows to determine how long it will take to recoup the initial investment.

Capital Budgeting

The process of planning and managing a firm's long-term investments in projects and assets.

Net Present Value

The calculation used to find today's value of a future stream of payments and receipts by discounting them at a specific rate, often used in capital budgeting to assess the profitability of an investment.

Q1: If the last dividend on Markowitz Trucking

Q16: All of the following are considered to

Q38: All of the following are problems with

Q46: The NPV method assumes that cash inflows

Q66: The _ shows the possible risk/return combinations

Q78: An annuity with an infinite life is

Q83: You have the opportunity to buy a

Q98: You just took out a $12,000 loan

Q103: You have just taken out a 30-year

Q123: Fishing supply company,Outside Tackle,has its returns graphed