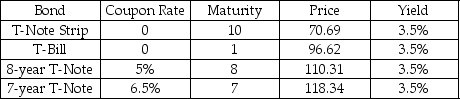

Each bond in the table has a face value of $100.The coupon bonds pay annual coupons,and the next coupon is due in one year.Assume that the yield curve is flat and all yields are currently 3.5%.If interest rates are forecast to rise to 4% from 3.5%,what is your profit if you short-sell the bond with the biggest anticipated (percentage) decline.(Assume you short-sell only one bond.)

Definitions:

Undifferentiated Targeting Strategy

A marketing approach where a company decides to ignore market segment differences and appeal to the whole market with one offer or product.

Mass-Marketing

Mass-marketing refers to a marketing strategy that aims to appeal to a large audience by using channels that reach a wide and diverse group of consumers simultaneously.

Segmenting And Positioning

The process of dividing a market into distinct groups of buyers and tailoring marketing strategies to meet their needs.

Positing

involves placing something firmly or putting forward an assertion, belief, or theory for consideration.

Q1: If the last dividend on Markowitz Trucking

Q5: If net income was $10,000,interest expense was

Q8: If you could borrow at 9.5% compounded

Q9: A $1,000 face value bond has a

Q43: The first step of the fatty acid

Q46: Suppose that you are reviewing a price

Q57: Jordan will need $20,000 at the end

Q75: A high-yield stock is one:<br>A) For which

Q93: Wernam Hogg Class A preferred shares have

Q96: What is the present value of $2,000