Multiple Choice

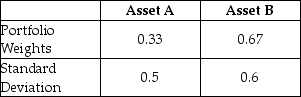

Consider the data provided in the table below for a portfolio of Assets A and B.The correlation of the two assets is ρ = -0.9523.What is the standard deviation of the returns of the portfolio?

Definitions:

Related Questions

Q1: You own a stock portfolio invested 30%

Q10: Which stock is cheapest relative to earnings?<br>A)

Q29: Tootsie Roll Industries Inc.<br>Income Statement<br>As of December

Q30: The following represents overall net equation for

Q37: How much will you need in 30

Q48: A firm has current assets of $350,000,current

Q67: The only way to prevent lactate accumulation

Q95: Peter Lynch has the following portfolio of

Q115: You want to buy $20,000 worth of

Q130: A beta coefficient of + 1 represents