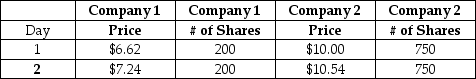

Consider a value-weighted market index that includes the two companies shown in the table.You form a portfolio to mimic the index on Day 1.The mimic portfolio is designed to earn the same return as the index.What is the portfolio weight for Company 1?

Definitions:

Multinomial Experiment

An experiment that leads to outcomes categorized into two or more non-overlapping categories.

Degrees of Freedom

The number of independent values or quantities that can vary in the calculation of a statistic, typically used in the context of statistical tests.

Test Statistic

A calculated value from sample data used to assess the viability of a hypothesis in a statistical test.

Degrees of Freedom

The count of distinct values or amounts that can be attributed to a statistical distribution while respecting all existing limitations.

Q8: High concentrations of ketone bodies in the

Q9: You are offered a perpetuity that will

Q27: Income Statement<br>Molson Coors Inc.<br>Years 1 & 2

Q27: Asset y has a beta of 1.2.The

Q28: The expected return on the market is

Q41: The principal anion of extracellular and intracellular

Q54: Ramble-On-Rose Florists Inc.common shares are priced at

Q57: The idea behind _ is that exchange

Q71: As blood moves from the arterial end

Q83: If interest rates are 5%,which of the