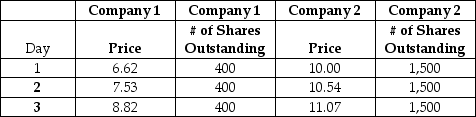

A popular value-weighted index is constructed out of shares in the two companies shown in the table,below.On Day 1 you construct a portfolio that mimics the index.In order for your portfolio to earn the same return as the index from Day 2 to Day 3,what portfolio weight do you need for Company 1 on Day 2?

Definitions:

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment by calculating the present value of all future cash flows minus the initial investment cost.

Simulation Analysis

is a method used in risk management to model possible outcomes of a decision by manipulating variables within mathematical or computer simulations.

NPV Estimates

Projections or calculations of the Net Present Value for different investments or projects to aid in decision-making.

Simulation Analysis

A technique used to predict the outcome of a project or investment by running multiple simulations with various sets of assumptions.

Q1: Consider the following reaction. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2243/.jpg" alt="Consider

Q1: Joe expects to receive a gift of

Q13: If an asset has a 35% probability

Q42: You have a 5-year amortized loan with

Q63: According to the internal rate of return

Q64: How much should an investor pay for

Q66: What is the price of a five-year

Q80: The fluid surrounding tissue cells is called

Q89: You are considering the purchase of a

Q122: A friend tips you off on a