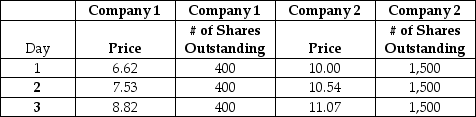

A popular value-weighted index is constructed out of shares in the two companies,shown in the table below.On Day 1 you construct a portfolio that mimics the index with 15% invested in Company 1 and 85% invested in Company 2.On Day 2,what trades do you need to make in order to adjust your portfolio weights so that your portfolio earns the same return as the index from Day 2 to Day 3?

Definitions:

Typographic Errors

Mistakes made in the typing or printing process, often resulting in incorrect spelling, punctuation, or layout in text.

Exponential Distribution

A statistical distribution used to model the time between events in a process where events occur continuously and independently at a constant average rate.

X-bar Chart

A statistical tool used in quality control processes to monitor the mean (average) of a series of samples over time and identify any significant shifts.

Normal Distribution

A probability distribution that is symmetric about the mean, showing that data near the mean are more frequent in occurrence than data far from the mean.

Q2: The table below shows selected financial data

Q11: Erythropoietin,a hormone that helps regulate red blood

Q14: Consider a 35 year coupon bond with

Q25: $1,200 is deposited today into an account

Q42: Your company is planning to open a

Q50: Tootsie Roll Industries Inc.<br>Income Statement<br>As of December

Q72: The Barby Division at Mattel Toys is

Q93: Amino acids of the amino acid pool

Q94: The present value of an ordinary annuity

Q99: Assume that the financial markets are in