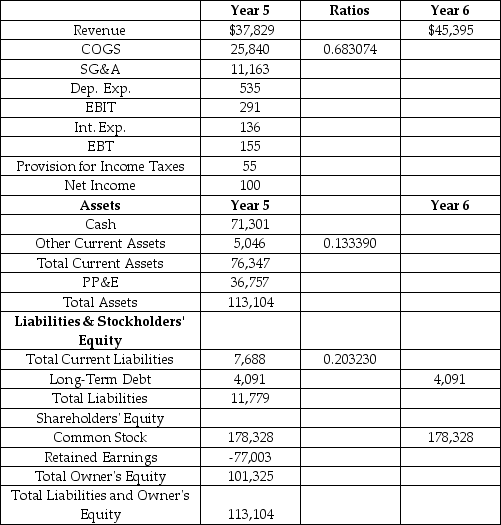

Q9 Networks is a leading provider of outsourced data center infrastructure such as web-servers and data storage.Forecast the financial statements for Q9 Networks for Year 6.Use the percent of sales method based on Year 5 and the assumptions listed below.Please note the ratios to sales provided in the table which are useful for making the forecast.Forecast the financial statements for Q9.What is the change in the cash account from Year 5 to Year 6?

Sales growth of 20%.The cost of debt is 4%.The Tax rate is 35%.The depreciation rate is 5%.CAPEX is $4,000,000.Cash is the plug account.The following accounts are held constant: Long-term debt and Common Stock.No dividends are paid in Year 6.

Q9 Networks

Income Statement and Balance Sheet

As of December 31,Year 5 ($ 000's)

Definitions:

Q9: Which of the following is not a

Q16: Last month,Springfield Power Co.announced that shareholders of

Q27: What is a usual default rate when

Q33: A bank pays a quoted annual (nominal)interest

Q36: How much does Ralph need to invest

Q41: Each of the following is a factor

Q42: You have a 5-year amortized loan with

Q45: The amount of foreign currency that one

Q76: The future value of $200 received today

Q79: The Mountain Jam Company purchased a machine