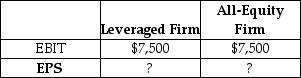

Consider two firms that are identical in every way except that one has $15,000 of debt and 500 shares of stock outstanding,while the other is all-equity and has 650 shares of stock outstanding.Assume that the debt is a perpetuity with annual coupons at the rate of 6%.What is each firms' earnings per share if EBIT is $7,500? Assume a tax rate of 40%.

Definitions:

Management by Exemption

A management style where leaders only intervene when standards are not met or when there are deviations from expected performance

Task-specific Self-efficacy

An individual’s internal expectancy to perform a specific task effectively.

Persuasion

The act or process of influencing someone's beliefs, attitudes, intentions, motivations, or behaviors through arguments, reasoning, or appeal.

Negative Consequences

Undesirable outcomes or penalties that result from a specific behavior or action, often serving as a deterrent for the behavior.

Q5: From a bond issuer's perspective,the IRR on

Q12: When the amount earned on a deposit

Q13: The _ is the rate of return

Q40: Mechano Construction Inc.generates perpetual annual EBIT of

Q46: Forward transactions<br>A) seldom benefit manufacturing firms.<br>B) typically

Q47: Boob-Tube Electronics Inc.has long term bonds with

Q75: The primary advantage of Eurobonds is<br>A) the

Q87: When the net proceeds from sale of

Q93: What is the future value of the

Q123: Historical weights are the present value of