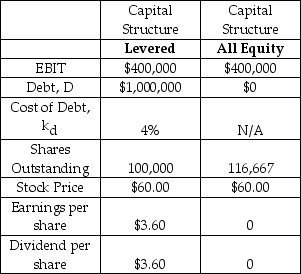

The Mohawk & Hudson Railway (M&H) currently has a levered capital structure,but it is considering a proposal to issue new equity (@$60/share) and use the proceeds to retire its debt.Selected financial information for M&H is provided in the table below.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 4% (and yield of 4%) .Assume that individual investors can borrow and lend at the same interest rate (and with the same terms) as corporations.

Charlie Jones,an engineer for the railway,owns 100 shares of M&H.Charlie receives annual dividend income of $360 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure,but Mohawk & Hudson has announced that it will not go forward with the change in capital structure.If Charlie sells 14.29 shares and lends the proceeds,then what are his annual investment cash flows?

Definitions:

Quality Control Chart

A graphic representation of process data over time, used to monitor the quality of processes.

Central Tendency

A statistical measure that identifies a single value as representative of a dataset, typically through the mean, median, or mode.

Measuring Samples

The act of collecting and analyzing a subset of data from a larger population to draw conclusions or make predictions.

Q7: Omnicorp is all equity financed and generates

Q10: Tootsie Roll Industries Inc.<br>Income Statement<br>As of December

Q26: Which of the following is not a

Q44: _ is the willingness of the borrower

Q45: Your banker is concerned about your company's

Q47: Which of the following is a variation

Q48: What is the dividend on an 8

Q49: The Boeing Corp.is considering building a new

Q94: Kathy deposited $100 in a savings account

Q106: Assuming the firm plans to pay out