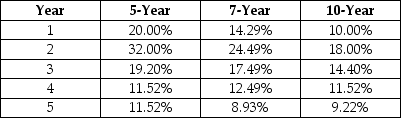

Droids-R-Us Inc.(DRU) ,is considering the installation of a new production line to make service mechanoids.The cost of the new manufacturing equipment is $2.2 million.The machines are classified as 7-year properties.(MACRS rates are provided in the table,below.) The machines will be purchased at the beginning of 2014.(DRU uses a mid-year placed-in-service convention.) DRU's engineers estimate that the new assembly line could be ready for operations in early 2014.Annual EBITDA is forecasted to be $1.3M for 2014 and all subsequent years of the project.DRU's marginal tax rate is 35%.What is the value of the depreciation tax shield in 2015? (Do NOT assume that the equipment is salvaged in 2015.) Round your answers to the nearest dollar.

Definitions:

Q4: If a manager prefers investments with greater

Q11: All of the following are necessary for

Q13: Which of the following statements is true?<br>A)

Q30: The Oval Bearing Corp.manufactures ball bearings.Oval Bearing

Q43: Wilson's Cabinets has bonds outstanding that mature

Q53: It is possible to reduce risk of

Q67: A(n)_ distribution shows all possible outcomes and

Q102: What is the interest tax shield?<br>A) The

Q120: The cost of common stock equity refers

Q123: Historical weights are the present value of