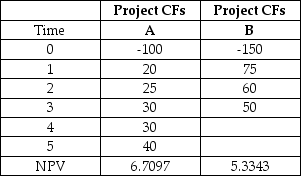

The cash flows for two projects,A and B,are shown in the table,below.Notice that Project A has a life of 5 years and Project B has a 3 year life.Calculate the NPV of each project and calculate which should be adopted using the equivalent annual annuity approach.Assume that the cost of capital is 10%.

Definitions:

Welfare Loss

Economic inefficiency resulting from a deviation from an optimal allocation of goods and services, often due to externalities or market power.

Net Social Gain

The overall benefit to society from an economic transaction, after subtracting costs.

Barriers To Entry

Factors that make it difficult for new competitors to enter a market.

Net Social Cost

The total monetary cost of the negative externalities produced by an activity or production, minus any benefits.

Q5: Standard deviation measures the dispersion of an

Q16: The return on the market is 11%.A

Q32: When discussing weighing schemes for calculating the

Q33: Martin Industries just paid an annual dividend

Q36: Rekall Inc.,the memory implant company,has 7 million

Q41: Flotation costs reduce the net proceeds from

Q59: Which component of a firm's capital structure

Q66: Net working capital is the amount by

Q84: The degree of operating leverage is defined

Q172: Which of the following is true of