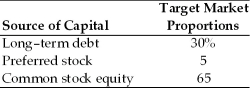

A firm has determined its optimal capital structure,which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value.The stock will pay an $8.00 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share.The dividend expected to be paid at the end of the coming year is $5.07.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.45.It is expected that to sell,a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Definitions:

Homan Sign

A clinical sign often used in the diagnosis of deep vein thrombosis (DVT), identified by pain in the calf or popliteal region upon dorsiflexion of the patient's foot.

High Pitched

High pitched describes sounds that are at the upper end of the audible spectrum, characterized by a high frequency.

Lack of Response

The absence or failure of a reaction to stimuli or treatment, implying a non-responsive state or condition.

CN XI

The eleventh cranial nerve, also known as the accessory nerve, which is responsible for controlling certain muscle movements in the shoulder and neck.

Q5: Agency costs pose the biggest problem for<br>A)

Q6: The theory suggesting that for any given

Q61: Preferred stock has characteristics of debt since

Q89: If Fluppy Dog Grooming shareholders require a

Q129: The cost of capital is a static

Q133: The cost of retained earnings is generally

Q163: A(n)_ yield curve reflects lower expected future

Q174: Using the data from Table 8.3,what is

Q180: A portfolio combining two assets whose returns

Q183: Emmy Lou,Inc.has an expected dividend next year