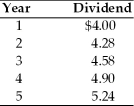

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year.A new issue of stock is expected to be sold for $98,with $2 per share representing the underpricing necessary in the competitive capital market.Flotation costs are expected to total $1 per share.The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

Definitions:

Metabolic Alkalosis

A disturbance in the body's acid-base balance, leading to an increase in blood pH due to excessive alkali in the body.

Gastric Suction

A procedure to remove stomach contents using a tube inserted through the nose or mouth into the stomach.

Pitting Edema

A symptom where pressure applied to the skin leaves a lasting indentation, often indicating fluid accumulation.

Interstitial

Relating to the small spaces or gaps between tissues or parts of an organ in the body.

Q2: Initek Co.'s stock trades for $12.50.Initek has

Q30: Benson's,Inc.has an overall cost of equity of

Q38: Gecko & Co.uses the residual dividend model

Q39: If investors require a 10% after-tax return

Q58: _ risk represents the portion of an

Q74: Which of the following is true of

Q94: Jerry's Dog Food,Inc.is a dog food wholesaler

Q110: If a corporation has an average tax

Q122: Returns from internationally diversified portfolios tend to

Q134: The reason for a difference in the