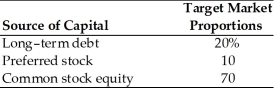

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's after-tax cost of debt is ________. (See Table 9.1)

Definitions:

One-to-many Relationship

A type of database relationship where a single record in one table is linked to multiple records in another table.

Criterion <=200

A specification or condition, such as a measurable limit or threshold, that dictates the selection or evaluation process (in this context, indicating a maximum value of 200).

Foreign Key Field

In databases, an attribute in a table that links to the primary key of another table, establishing a relationship between the tables.

One-to-many Relationship

A one-to-many relationship in databases is a type of link between two tables where a record in the first table can be associated with one or more records in the second table.

Q20: Treasury stocks held within the corporation do

Q21: Duddy Kravitz owns the Saint Viateur Bagel

Q34: What is the weighted average cost of

Q51: Subordination means that subsequent creditors agree to

Q57: The _ of a given outcome is

Q65: Beta coefficient is an index of the

Q81: Tangshan Mining is considering issuing preferred stock.The

Q139: The nominal rate of interest is the

Q169: In the capital asset pricing model,the beta

Q186: The widely shared expectations of hard times