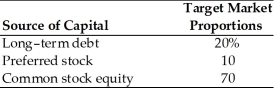

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of preferred stock is ________. (See Table 9.1)

Definitions:

Buying Center

A group of individuals within an organization who are involved in the process of evaluating and making purchase decisions.

Buying Center

A collection of people in an organization involved in the process of deciding to buy products or services.

Organizational Culture

The set of shared values, beliefs, practices, and norms that characterizes an organization and influences its functioning.

World Trade Organization

An international organization designed to supervise and liberalize world trade by providing a forum for negotiating trade agreements and a place for resolving trade disputes.

Q10: Smith has current assets of $800,000,which can

Q23: Smith Motors Inc.manufactures,distributes,and services automotive parts and

Q31: Money market securities have maturities of one

Q45: When agency and bankruptcy costs are considered,the

Q78: _ means that subsequent creditors agree to

Q125: The free cash flow valuation model is

Q131: If a manager requires greater return when

Q148: Jia's Kitchen Stuff has recently sold 1,000

Q151: Edward Accounting Services has an outstanding issue

Q152: Supervoting shares of common stock provide shareholders