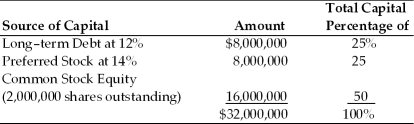

Zheng Sen's Chinese Take-Out had earnings before interest and taxes of $4,000,000 last year.The firm has a marginal tax rate of 40 percent and currently has the following capital structure:  (a)Calculate the firm's after-tax return on equity (ROE)and earnings per share (EPS).

(a)Calculate the firm's after-tax return on equity (ROE)and earnings per share (EPS).

(b)If the firm retires $4,000,000 of preferred stock using the proceeds from an equal increase in long-term debt,what would have been the after-tax return on equity (ROE)and earnings per share (EPS)?

(c)If the firm retires $4,000,000 of preferred stock using the proceeds from the sale of 500,000 shares of common stock,what would have been the after-tax return on equity (ROE)and earnings per share (EPS)?

Definitions:

Fraud

The intentional deception or misrepresentation made by one party to another, resulting in harm or loss.

Shareholders

Individuals or entities that own one or more shares of stock in a corporation, making them owners of a portion of the corporation.

Unaffiliated Directors

Board members who do not have a direct or substantial interest in the company, ensuring independence from the company’s management.

Outside Directors

Members of a company's board of directors who are not part of the company's management team and are theoretically independent of the company.

Q21: _ are commonly issued in the reorganization

Q34: The purpose of the restrictive debt covenant

Q36: Which of the following are rights of

Q60: Laurie wants to buy a used sports

Q71: The common stock book value model ignores

Q79: The Mountain Jam Company purchased a machine

Q90: The cost of common stock equity capital

Q146: In valuation of common stock,the price/earnings multiple

Q154: The portfolio with a standard deviation of

Q193: To compensate for the uncertainty of future