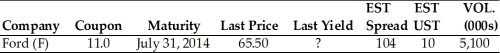

Table 6.1

Assume the below information to answer the following question(s) .

-Based on the Table 6.1, assume this bond's face value is $1,000. What is the bond's current market price?

Definitions:

Working Capital

The difference between a company's current assets and current liabilities, indicating the liquidity available to run its day-to-day operations.

Short-Term Debt

Financial obligations due within one year, used by companies for immediate financing needs.

Healthy Profitability

Healthy profitability indicates a robust and sustainable level of earnings for a business, suggesting it is well-positioned for growth and stability.

Mezzanine Capital

is a form of financing that is a mix between equity and debt, often taking the form of convertible debt or subordinate debt, used by companies for expansion.

Q25: The annual rate of return is referred

Q34: Of the following components of a cash

Q49: A firm's final sales forecast is usually

Q52: _ is used to finance "rolling stock"-airplanes,trucks,boats,railroad

Q80: Behavioral finance is a growing body of

Q115: In the statement of cash flows,cash flows

Q118: The pro forma total liabilities amount is

Q120: Which of the following valuation methods is

Q121: General Talc Mines may prepare to _.(See

Q121: A portfolio of two negatively correlated assets