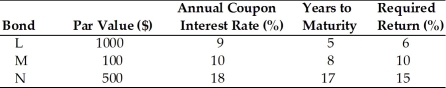

Table 6.2

-Calculate the current value of Bond M. (See Table 6.2)

Definitions:

Discounting

A financial technique that calculates the present value of future cash flows by applying a discount rate.

Net Present Value

A financial metric that calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Cash Flows

Cash flows represent the movement of money into and out of a business, indicating its liquidity and financial health.

Early Years

Early years typically refers to the period in human development from birth to the start of formal education, emphasizing the importance of nurturing and education in a child's early life.

Q3: Nico makes annual end-of-year payments of $5,043.71

Q5: Everything else being equal,the higher the interest

Q9: The security market line (SML)reflects the required

Q68: In the capital asset pricing model,an increase

Q117: Current ratio provides a firm's ability to

Q118: Any action taken by a financial manager

Q123: What annual rate of return would Jia

Q151: In comparing an ordinary annuity and an

Q152: The key inputs to the valuation process

Q222: Yield to maturity (YTM)is the rate investors