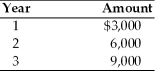

Find the future value at the end of year 3 of the following stream of cash flows received at the end of each year,assuming the firm can earn 17 percent on its investments.

Definitions:

Put Option

A financial contract allowing the holder to sell a stock, bond, commodity, or other asset at a specified price within a certain period.

Writer

In finance, it refers to the seller of an option contract, who is obligated to buy or sell the underlying asset if the option is exercised.

Premium

The amount by which the price of a security or insurance policy exceeds its par or face value or the cost of acquiring an option or futures contract.

Strike Price

The predetermined price at which an option can be exercised, either to buy or sell the underlying asset.

Q3: The purpose of the restrictive debt covenant

Q21: Which of the following is usually a

Q63: A bond will sell at a premium

Q89: If Dana Dairy Products has credit terms

Q97: A firm has an outstanding issue of

Q107: In an efficient market,the expected return and

Q111: Which of the following ratios is difficult

Q148: Gong Li has recently inherited $10,000 and

Q164: The modified DuPont formula relates the firm's

Q169: A proxy statement is a statement transferring