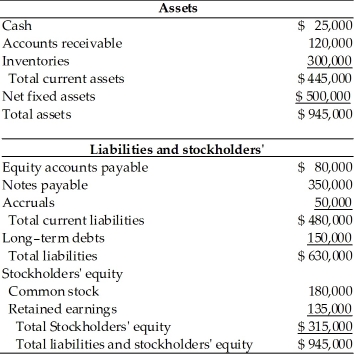

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma net fixed assets amount is ________. (See Table 4.5)

Definitions:

Lead Initiation

The process of identifying and beginning contact with potential customers or clients.

Leads

Potential customers who have shown interest in a company's products or services, often considered the first step in the sales process.

Prospects

Potential customers or clients who have been identified as having the interest and ability to purchase a product or service but have not yet made the transaction.

Qualified Prospects

Potential customers who have been evaluated and deemed likely to purchase, based on specific criteria such as need, ability, and authority to buy.

Q48: The value of an asset is determined

Q51: Revolving credit agreements are non-guaranteed loans that

Q59: Investment banks are institutions that _.<br>A) perform

Q65: The time value concept/calculation used in amortizing

Q81: Most businesses raise money by selling their

Q87: Net fixed assets represent the difference between

Q129: In the statement of cash flows,retained earnings

Q152: Market ratios only measure the risk.

Q169: Exchange rate risk can often be hedged

Q169: The future value of $200 received today