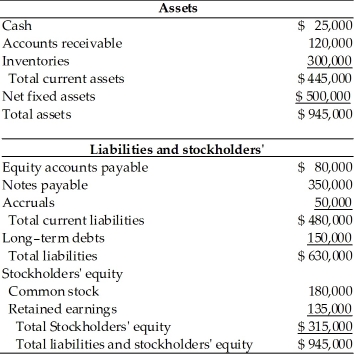

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma current liabilities amount is ________. (See Table 4.5)

Definitions:

Predicted Benefits

Expected advantages or improvements that result from a particular action or policy.

System-1

Fast, automatic, intuitive approach of processing information, often contrasted with the slower, more deliberate reasoning of System 2.

System-2

A term used in psychology referring to the analytical and conscious mode of thinking, characterized by slower, more deliberate, and logical reasoning.

Ethical Decisions

Choices made based on moral principles and values, considering what is right and wrong.

Q8: The _ method of developing a pro

Q47: In the Eurobond market,corporations and governments typically

Q53: The net cash flow for February is

Q57: Gross profit margin measures the percentage of

Q74: How long would it take for Nico

Q90: When computing an interest or growth rate,the

Q100: The firm has a negative net cash

Q158: If a pro forma balance sheet dated

Q178: A corporate financial analyst must calculate the

Q211: In a bond indenture,the term "security interest"