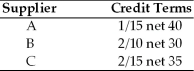

Ashley's Delivery Service is analyzing the credit terms of each of three suppliers,A,B,and C.  (a)Determine the approximate cost of giving up the cash discount (assume a 360-day year).

(a)Determine the approximate cost of giving up the cash discount (assume a 360-day year).

(b)Assuming the firm needs short-term financing,recommend whether or not the firm should give up the cash discount or borrow from the bank at 10 percent annual interest.Evaluate each supplier separately.

Definitions:

Uncollectible Accounts Expense

Expenses related to uncollectible amounts from credit sales.

Allowance Account

A contra account that reduces the total amount of accounts receivable on the balance sheet to reflect uncollectible amounts.

Accounts Receivable

Amounts owed to a company by customers for goods or services provided on credit.

Uncollectible Accounts

Accounts receivable that a company has deemed uncollectible from debtors, leading to their classification as bad debts.

Q26: The _ ratio may indicate poor collections

Q81: Pledges of accounts receivable are never made

Q85: NICO Corporation had net current assets of

Q92: Operating-change restrictions gives the bank a right

Q105: Global Logistics purchased a new machine on

Q124: When a portion of a firm's fixed

Q146: Notes payable are either spontaneous secured or

Q178: Accounts receivable for CEE in 2013 was

Q220: A decrease in the production time to

Q275: A popular extension of materials requirement planning