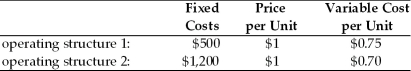

China America Manufacturing is evaluating two different operating structures which are described below.The firm has annual interest expense of $250,common shares outstanding of 1,000,and a tax rate of 40 percent.  (a)For each operating structure,calculate

(a)For each operating structure,calculate

(a1)EBIT and EPS at 10,000,20,000,and 30,000 units.

(a2)the degree of operating leverage (DOL)and degree of total leverage (DTL)using 20,000 units as a base sales level.

(a3)the operating breakeven point in units.

(b)Which operating structure has greater operating leverage and business risk?

(c)If China America projects sales of 20,000 units,which operating structure is recommended?

Definitions:

Positive Rewards

Stimuli or reinforcements that increase the likelihood of a repeating behavior by inducing a pleasurable outcome.

Operant Conditioning

A learning configuration where the conditioning of behavior strength turns on the axis of reinforcement or punitive action.

Schizophrenia

A chronic brain disorder that affects a person's ability to think, feel, and behave clearly.

Rational

Based on or in accordance with reason or logic; capable of logical or reasoned thinking.

Q51: The accept-reject approach involves the ranking of

Q64: For a project that has an initial

Q77: 2/15 net 45 translates as 2 percent

Q113: An excess earnings accumulation tax is levied

Q123: The closer the base sales level used

Q133: Calculate the initial investment required for the

Q189: Relevant cash flows for a project are

Q191: _ leverage measures the effect of fixed

Q207: A firm has arranged for a lockbox

Q271: An increase in collection efforts by a