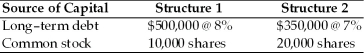

Frankline Coin,Inc.is considering two capital structures.The key information follows.Assume a 40 percent tax rate and expected EBIT of $50,000.  (a)Calculate two EBIT-EPS coordinates for each of the structures.

(a)Calculate two EBIT-EPS coordinates for each of the structures.

(b)Indicate over what EBIT range,if any,each structure is preferred.

Definitions:

Persuasive Reason

An argument or factor presented to convince or influence others to support a decision, action, or change in belief or behavior.

Conglomerate Mergers

Mergers between companies that operate in entirely different industries.

Anticompetitive Effects

Consequences or actions that reduce competition in a market, often associated with monopolistic practices and regulatory scrutiny.

Financial Mergers

Financial mergers involve the combination of two or more companies in the financial sector to create a new entity, aiming to enhance financial strength and market presence.

Q10: The annual incremental after-tax cash flow from

Q13: The annualized NPV of Project A is

Q22: The representative theory of dividends,as espoused by

Q24: The dollar breakeven sales level can be

Q32: An advantage of a _ is that

Q61: According to Modigliani and Miller,a firm's value

Q76: An important cash inflow in the analysis

Q97: Which projects should the firm implement? (See

Q113: An excess earnings accumulation tax is levied

Q129: Which of the following proposed projects should