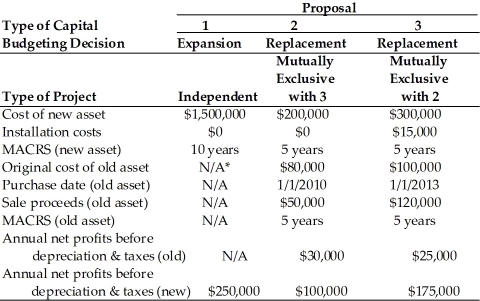

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 3, the incremental depreciation expense for year 6 is ________. (See Table 11.2)

Definitions:

Q1: For Proposal 3,the annual incremental after-tax cash

Q12: In capital budgeting,the preferred approaches in assessing

Q13: Stock dividends are _.<br>A) taxable at a

Q44: Disbursement float is experienced by a payee

Q49: Which of the following is true of

Q54: Scenario analysis is a behavioral approach that

Q57: A firm is evaluating an investment proposal

Q67: The higher the degree of financial leverage

Q77: A financial analyst is responsible for maintaining

Q107: All of the following are true of