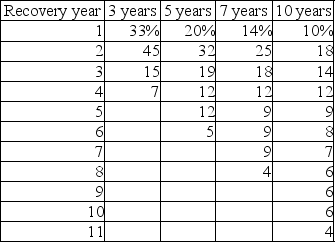

-A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow. The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $15,000. The machine has an original purchase price of $80,000, installation cost of $20,000, and will be depreciated under the five-year MACRS. Net working capital is expected to decline by $5,000. The firm has a 40 percent tax rate on ordinary income and long-term capital gain. The terminal cash flow is ________.

Definitions:

Physical Appearance

The outward look of an individual, including features, expressions, and overall visual impression.

Cerebral Cortex

The outer layer of neural tissue of the cerebrum in the brain, crucial for complex cognitive processes such as thought, memory, and consciousness.

Evolutionary Psychology

A methodology within the natural and social sciences, focusing on understanding the mind's architecture from a current evolutionary standpoint.

Reproductive Success

An individual's passing of genes to the next generation, often measured by the number of offspring that survive to reproductive age.

Q26: The present value of the project's annual

Q41: In securing personal loans from family members

Q44: The annualized NPV of Project B is

Q53: _ is one of the primary responsibilities

Q58: You could reduce the size of your

Q68: Which of the following is a reason

Q75: In developing the cash flows for an

Q92: Due to clientele effect,Modigliani and Miller argue

Q148: Poor capital structure decisions can result in

Q194: For Proposal 2,the annual incremental after-tax cash