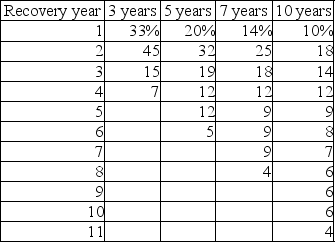

-A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow. The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $2,000. The machine has an original purchase price of $80,000, installation cost of $20,000, and will be depreciated under the five-year MACRS. Net working capital is expected to decline by $5,000. The firm has a 40 percent tax rate on ordinary income and long-term capital gain. The terminal cash flow is ________.

Definitions:

Memory Storage

The process of retaining information over time, which includes encoding, storing, and retrieving data.

Brain Structure

The physical organization and arrangement of different parts of the brain, including its cells and connections.

Sensory Relay Station

Refers to the thalamus, a structure in the brain that processes and relays sensory information to the appropriate areas of the brain.

Thalamus

A structure in the brain that acts as a relay station for sensory and motor signals to the cerebral cortex.

Q9: A firm has fixed operating costs of

Q35: The difference by which the required discount

Q56: Having a longer term loan<br>A) costs you

Q64: Assuming a 40 percent tax rate,what is

Q69: A firm's _ is the level of

Q72: Since lenders are generally reluctant to grant

Q100: The output of simulation provides an excellent

Q109: Payback is considered an unsophisticated capital budgeting

Q131: A firm has fixed operating costs of

Q144: Consider the following projects,X and Y where