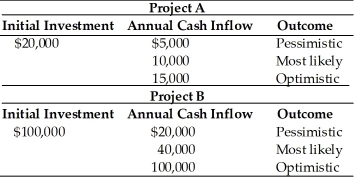

Table 11.6

A corporation is assessing the risk of two capital budgeting proposals.The financial analysts have developed pessimistic,most likely,and optimistic estimates of the annual cash inflows which are given in the following table.The firm's cost of capital is 10 percent.

-The expected net present value of Project A if the outcomes are equally probable and the project has five-year life is ________.(See Table 11.6)

Definitions:

Disaffirm

The act of rejecting or renouncing a contract or agreement, particularly by a minor who is not legally bound by contracts.

Life Insurance

A contract between an insurer and a policyholder where the insurer pledges payment of a death benefit to named beneficiaries upon the death of the insured.

Health Insurance

A type of insurance coverage that typically pays for medical, surgical, prescription drug, and sometimes dental expenses incurred by the insured.

Education Loans

Financial loans provided to students to help cover the costs of post-secondary education, which typically have to be repaid with interest after graduation.

Q52: The financial decision makers find NPV more

Q65: Consider the following projects,X and Y where

Q70: According to the residual theory of dividends,if

Q72: A project must be rejected if its

Q86: A _ is responsible for the firm's

Q98: _ leverage is concerned with the relationship

Q99: Holding all other factors constant,a firm that

Q125: You obtain a loan of $3,000 based

Q128: Which of the following is true of

Q188: A corporation borrows $1,000,000 at 10 percent