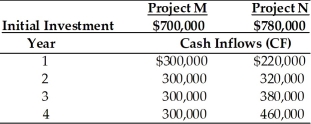

Table 11.8

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below.Tangshan Mining's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation,the NPV for Project M is ________.(See Table 11.8)

Definitions:

Accounts Receivable

Funds that customers owe to a business for products or services provided but for which payment has not yet been received.

Unearned Sales Revenues

A liability on a company's balance sheet that represents revenue received before the company has delivered goods or services.

Sales Revenues

Sales revenues refer to the income generated from the sale of goods or services by a company before any expenses are subtracted, indicating the primary source of business income.

Operating Expenses

Costs related to the day-to-day functions of a business, excluding cost of goods sold, but including items like rent, salaries, utilities, and depreciation.

Q6: For Proposal 2,the initial outlay equals _.(See

Q29: MasterCard and Visa credit cards are not

Q44: Ignoring general market fluctuations,the stock's price would

Q57: Which of the following methods of calculating

Q59: The board of directors is typically responsible

Q103: For Proposal 2,the tax effect on the

Q109: Payback is considered an unsophisticated capital budgeting

Q110: Longer maturities for loans result in lower

Q127: _ is the risk of being unable

Q162: Accounting figures and cash flows are not